How does Birmingham spend its tax money?

A Deep Dive into Birmingham’s Tax Spending

Since 2022, the city of Birmingham has witnessed a sharp increase in its revenue collection, amassing over $850 million from sales tax and local businesses. The local treasury has enjoyed growing coffers, rejuvenated business activities, and increased sales, all contributing to an upward trajectory in tax collection. Contributions from small, medium, and large-scale businesses in Birmingham have been instrumental in the revenue hike.

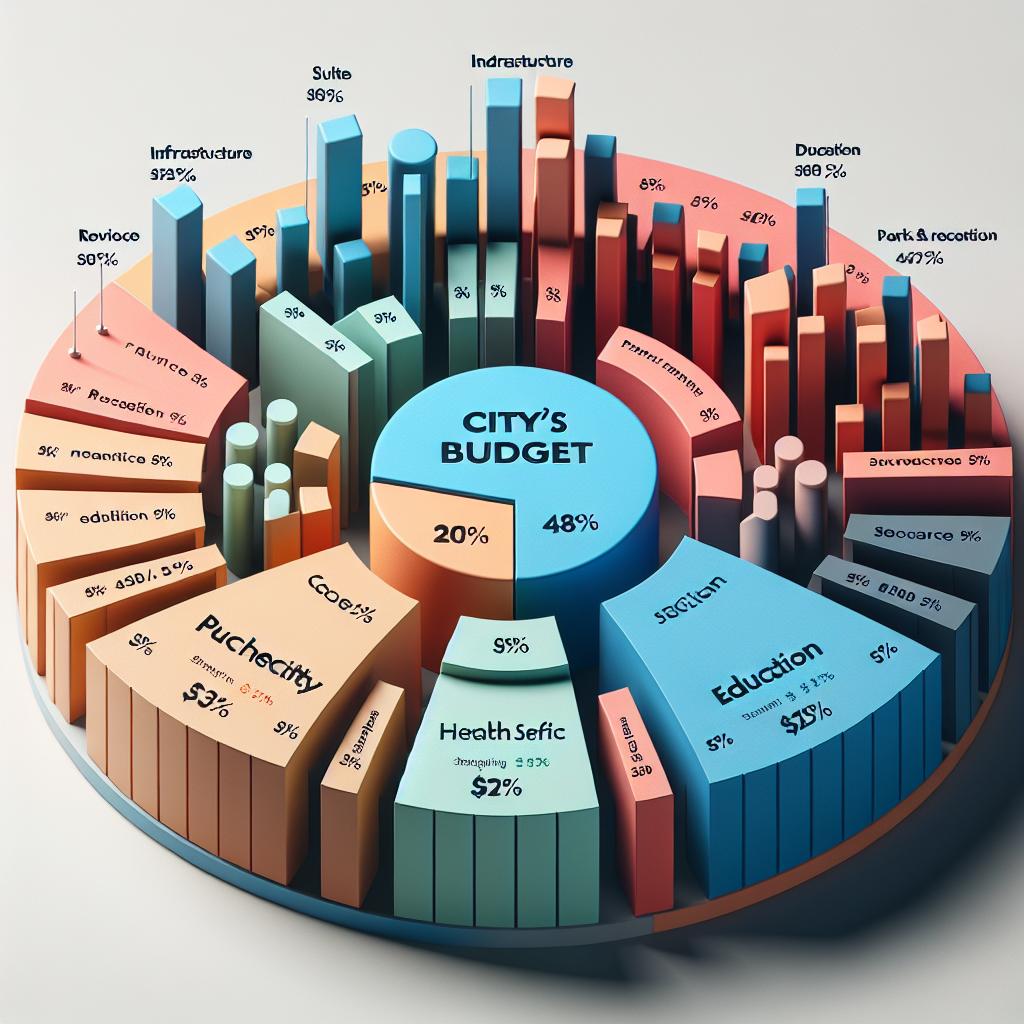

The city’s impressive revenue collection provides ample room for speculation on how much and where the authorities have been investing the funds. According to recent reports, Birmingham’s tax spending focuses on enhancing infrastructural development, fostering economic growth, and providing essential amenities and public services.

The Tax Breakdown

To further analyze how Birmingham utilizes its tax money, a closer look at the city’s budget documents from 2025 is required. Interestingly, by July 2026, the city anticipates a tax revenue increment, foreseeing over $850 million more in its coffers. Its well-structured taxation regime and collective effort among local businesses trigger this optimism. The city has seen an approximate 5% increase in tax revenue over the past three years, attributed mainly to business recovery efforts post-pandemic. The city tax expenditure makes allocations to both fixed obligations and variable projects and initiatives.

Fixed obligations consume a substantial portion of the tax revenue and include administrative expenses, regular road maintenance, city parks, public facilities upkeep, police, fire stations services, and sanitation.

Variable allocations involve funding various city projects and initiatives such as improving the city’s educational infrastructure, increasing public transport connectivity, enhancing parks and recreational facilities, resourcing community policing, and supporting local businesses and startups.

Key Expenditure Domains

A significant proportion of the collected tax money goes into servicing the city’s basic and crucial functions, ensuring the welfare of its citizens. It includes:

- Healthcare: Birmingham tasks itself with the health of its citizens exceptionally seriously. Hence, a considerable proportion of the collected revenue is invested in maintaining and upgrading the city’s healthcare facilities and services.

- Education: The city spares no expense in matters pertaining to education, acknowledging this as an indispensable pillar in ensuring future growth and prosperity.

- Public Safety: Providing citizens with a safe and secure environment is another top priority for Birmingham. Therefore, a sizable chunk of the revenue is allotted for community policing to maintain law and order.

- City Structures: From maintaining good conditions of public parks and recreational facilities to ensuring roads and other city structures are in prime condition, tax dollars are consistently invested in Birmingham’s infrastructure.

Final Thoughts

It is clear that Birmingham’s expenditure of its tax revenues is both balanced and targeted towards crucial areas of public welfare and city maintenance. The city understands the significant role these sectors play towards a safe, prosperous, and vibrant city. It seems with a projected growth in tax revenue, the city of Birmingham has a promising future in offering increasingly improved services and a resoundingly good quality of life to its citizens.